The reversal of fortune in the stock market has been stunning for both its scope and speed. The precipitating factor for the reversal, however, has been even more stunning, because it wasn't in anyone's forecast entering the year. We're talking about the coronavirus (COVID-19).

In the mind of the World Health Organization, COVID-19 has turned into a global pandemic. In the market's mind, it has turned into a Black Swan that has shut down major economies, shaken consumer and business confidence, and killed the bull market.

The bull market was running strong less than a month ago, but how quickly things have changed. Since its all-time high on February 19, the S&P 500 has crashed as much as 27%.

Today, we briefly discuss why and whether it's an opportune time to buy into the

stock market after the crash.

Killing Economic Growth

As we discussed last week, there is something distinctly different about the coronavirus versus the flu. We are not speaking of biological differences, caseloads, mortality rates, or anything of the like. We are speaking in terms of the reaction to the coronavirus. That reaction has been extraordinary.

Entire cities are being quarantined; Italy has closed all shops, except grocery stores and pharmacies; travel bans are being imposed; professional sports leagues are suspending or canceling their seasons; schools and colleges are being closed; Disney is closing its theme parks; central banks are announcing emergency rate cuts and massive liquidity injections; and government leaders are crafting fiscal stimulus plans.

In brief, major economies are shutting down in an effort to try to curtail the spread of COVID-19, which isn't expected to meet its match with a vaccine for another 12-18 months. The lockdown/shutdown procedures are killing economic growth and, in turn, the higher earnings growth expectations on which premium multiples entering the year were resting. The latter has been at the root of the stock market selloff, as the writing is on the wall that earnings estimates are going to be marked down sharply. Accordingly, premium valuations can't be justified, which has spurred a broad wave of selling that is discounting that reality.

A collapse in oil prices, which started with global growth concerns and accelerated with Saudi Arabia launching a price war in answer to Russia not agreeing to cut output any further to help stabilize oil prices, has only added to the mix of earnings concerns.

Knock-on Effects

A separate concern is that monetary policy isn't effective fighting a health crisis. Sure, it can help ensure that liquidity keeps flowing in the financial markets, but it can't convince a consumer to book a cruise at this juncture or, for that matter, a business like the NBA to refrain from suspending its season.

In the same vein, fiscal stimulus might not do the trick either -- at least not initially. It can help keep things from getting any worse economically, but, again, if one is worried about having their health compromised in large public gatherings, they aren't going to book a cruise because they have some extra money in their pocket.

The cure to those health concerns will be in the data and when that data suggest the caseload is peaking. That time could be relatively near or not, which is a major headwind for the stock market. The uncertainty regarding the spread of the coronavirus makes it difficult to forecast earnings growth, which is why we are hearing more and more companies pull their 2020 guidance.

What's beginning to register for the stock market, though, is that there are knock-on effects of the coronavirus issue that extend beyond the stock market.

Liquidity issues have disrupted Treasury financing markets; business disruption issues and plunging oil prices threaten to invite a spike in jobless claims that erodes consumer confidence; municipal funding matters arise with the downturn in business activity; a decline in earnings foments concerns about debt repayment capabilities; and the specter of recession can change the calculus on election outcomes.

There is always uncertainty, but with a Black Swan happening, like a global pandemic, there is a heightened sense of uncertainty that leads to a natural course of de-risking. The speed with which that has happened, though, has been remarkable and, undoubtedly, a blow to investor confidence in the manner that the fallout from the dot-com bust and the financial crisis were a blow to investor confidence.

The implication is that the hurdle rate for a V-shaped recovery to prior highs has gone up considerably. We can't definitively rule one out, but this latest market crash episode (and, yes, we'll call it a crash) has presumably quieted the animal spirits that were stirring in the fourth quarter of 2019 and early 2020.

"P" falling faster than "E"

Less than a month ago, the S&P 500 was trading at 19.1x forward twelve-month earnings. Today, it is trading at 14.5x forward twelve-month earnings, which is a slight discount to the 10-yr average of 15.0x. That's a better entry point for long-term investors, but it's a valuation that can't be taken at face value because it does not incorporate the sharp cut to earnings estimates that seems inevitable.

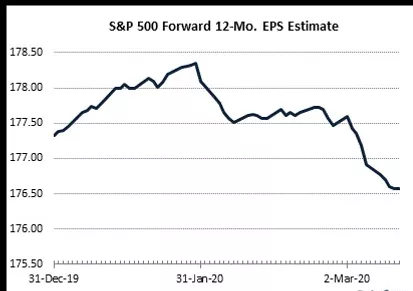

The forward 12-month EPS estimate of $176.58, has only come down 0.6% since February 19. After 9/11, the forward twelve-month EPS estimate was cut by 5.8%. During the financial crisis, it was cut by 35%.

We don't know where things will settle in terms of earnings estimates, but it makes a difference in today's valuation assessment following the steep decline in stock prices. For example, the market would be trading at 17.0x forward twelve-month earnings right now with a 15% reduction to the forward twelve-month EPS growth estimate. Since the view ahead is in such flux, it is advisable to a take a look at the trailing twelve-month multiple, which incorporates earnings that have already been recorded, to get a better line on valuation.

In that light, the S&P 500 is trading at 17.5x earnings, which is a 5% premium to the 10-yr historical average of 16.6x. On that basis, the market isn't a bargain, even if some individual stocks are, after the steep decline since February 19.

Granted long-term rates have come way down, which does lend stocks some relative appeal versus bonds; however, the S&P 500 could slide to the 2425 level and still only be trading in-line with the 10-yr average for the trailing twelve-month P/E multiple. There is notable downside risk to earnings estimates right now and that trend won't reverse until the economic data show the economy is coming back strongly from the coronavirus-induced shutdown.

What It All Means

With the economic dislocation created by the coronavirus and the risk of recession rising, one should expect to see the forward twelve-month EPS estimate continue to come down.

Accordingly, the market isn't the value it appears to be at 14.5x forward twelve-month earnings. In fact, it is still difficult to know how to value it on that basis, because the extent of the coronavirus impact on the economy and earnings remains unknown. Despite the huge selloff, the S&P 500 still trades at a slight premium to the 10-yr historical average of 16.6x for trailing twelve-month earnings. It's less expensive than it was less than a month ago, then, but it still isn't "cheap."

The market also isn't acting in an investor-friendly manner either with volatile price swings rooted in uncertainty about the economic and earnings outlook, as well as burgeoning angst about the condition of credit markets.

There are still a lot of "known unknowns" to settle, which is why it's still a risky time for investors without a long-term mindset. The economic data is only going to get worse in coming months, which begs the question as to whether that reality is already incorporated in stock prices. It certainly isn't incorporated in earnings estimates, so tread carefully with the view that it is going to be a V-shaped recovery for the stock market. It may be more like a "W" because the earnings impact from the unprecedented economic effects of the coronavirus hasn't been priced into the stock market, or, more alarmingly perhaps, into the credit markets.

At this juncture, it's more of a stock picker's market than the catch-all market it was less than a month ago, so one should be favoring companies with sound balance sheets and secure dividends that will stand the test of volatile times.

When our readers follow our proprietary GREENMARK 101 algorithm, your money is safer than any information source currently available. Not a bold statement, but a fact. Our article ...

"WHAT DOES CORONVIRUS MEAN FOR YOUR STOCK INVESTMENTS?" dated February 25, 2020 was your "wake-up call, " and not the first time our analytics were on point. For three years, we have presented reliable information without the noise.

Most of our readers listened, instead of losing a small fortune, they protected what's theirs.